Consulting Services

We engage in many business consulting projects that deal with consulting on startups or growing businesses and their structure, accounting, payroll and other financial and technological needs. There are five entity types to choose from—sole proprietorship, partnership, LLP, LLC, and corporation—, each with their own legal and tax consequences. We can help you select the best one for your current and future business needs. In consulting we can provide an analysis that can be used in or as an argument for an accounting and/or tax position taken or in an opinion to be given.

Start up/Expanding Companies

The type of entity your business is structured as is important as there are legal and tax implications associated with a chosen structure. We'll provide you the right information to help you make an informed decision, help you to create a business plan as well as bylaws or operating agreements.

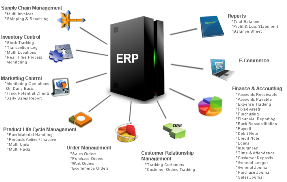

Software Solutions

Since record keeping and operations are important, it is important to choose software that makes it efficient. There are many software packages to choose from, we'll help you choose and implement the right accounting as well as document and customer management software for your business.

Tax Planning

When you would like to know how situations will affect you taxwise we can help. We can tell you how much you may owe or how much is owed to you based on estimated (or actual)income and hypothetical or actual situations that may affect you in a given year.

Whether you are a person or business with a hypothetical or actual situation for which you require professional advice to be used by you or your clients, you can contact us to consult as we stand ready to engage in business consulting projects with partners and clients alike.